- May 21, 2018

- 148

- 10

The current management at AA is operating the Airline on CREDIT. They are using the Billions of profit to buy back stock for themselves and then Borrow Money to operate the Airline. The current Debt is approx. 25 BILLION DOLLARS and Climbing.

To make matters worse 12 billion of the debt has to be repaid by 2021 and 1 Billion is due for Pension Payments in the next 18 months. All this debt is coming due at the same time Fuel Prices are INCREASING.

This is the "Perfect Storm" for ANOTHER Chapter 11 in the next 3 years.

The May DFW Crew News one of the pilots asked Robert Isom this very question about the debt and he basically danced all around it for 5 minutes without directly answering it.

As a TWU member everyone seems to be looking at the big fire down the street called the JCBA while the next street over the AA house is burning down to the ground in DEBT.

All I'm doing with this posting is pulling the Fire Alarm because I don't have any way to put out the DEBT Fire.

Please compare our Debt to Equity Ratio with Delta.

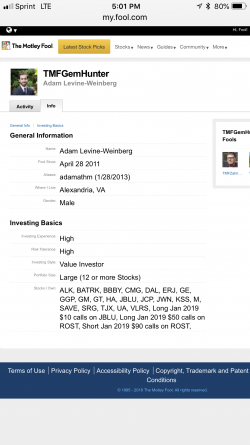

https://www.fool.com/investing/gene...ican-airlines-making-a-9-billion-mistake.aspx

https://marketrealist.com/2017/07/why-investors-should-be-concerned-about-american-airlines-

debt

https://www.fool.com/investing/2018/03/12/american-airlines-is-still-wasting-investors-money.aspx

https://www.fool.com/investing/2018/05/02/rising-costs-hit-american-airlines-group-inc-again.aspx

To make matters worse 12 billion of the debt has to be repaid by 2021 and 1 Billion is due for Pension Payments in the next 18 months. All this debt is coming due at the same time Fuel Prices are INCREASING.

This is the "Perfect Storm" for ANOTHER Chapter 11 in the next 3 years.

The May DFW Crew News one of the pilots asked Robert Isom this very question about the debt and he basically danced all around it for 5 minutes without directly answering it.

As a TWU member everyone seems to be looking at the big fire down the street called the JCBA while the next street over the AA house is burning down to the ground in DEBT.

All I'm doing with this posting is pulling the Fire Alarm because I don't have any way to put out the DEBT Fire.

Please compare our Debt to Equity Ratio with Delta.

https://www.fool.com/investing/gene...ican-airlines-making-a-9-billion-mistake.aspx

https://marketrealist.com/2017/07/why-investors-should-be-concerned-about-american-airlines-

debt

https://www.fool.com/investing/2018/03/12/american-airlines-is-still-wasting-investors-money.aspx

https://www.fool.com/investing/2018/05/02/rising-costs-hit-american-airlines-group-inc-again.aspx