topDawg

Veteran

- Joined

- Nov 23, 2010

- Messages

- 2,957

- Reaction score

- 2,298

American is in sorry shape. They said they would focus on paying down debt this time so we will see if that comes true or if they start throwing out buy backs again to match Delta/United.Holy crap guys. This is alarming, is it not? 75 Billion debt? Is this true?? If I remember correctly the last time they filed for BK they were a mere 32-35 Billion in debt. And now AA has a number (yes, more than a few) of law suits against them for many different reasons and from different entities, including the DOT, DOJ, and the suit on the NEA with JB that the Gov is suing over.

Just came across this article and was flabbergasted by how much debt AA has this time around (if all is true). Does this not put them at a 66%-75% chance of going BK again?? United at 52%, but has way more avenues they can go prior to hitting the BK button where AA does not any longer as they ate up all their options early on. I leave you all with the article below. Also don't forget the super increased pay for Pilots to keep flying at AA as well as at all the regional airlines that gets passed onto AA cost as well.

Prepare yourselves folks. It may never come to it, BUT, YOU never know, so prepare for the worse. Just like last time, NOBODY thought they would have filed for BK when they had all those BILIIONS 5-6 in cash and reserves last time, never say never, get prepared folks.

the bolded is wrong and is a large part of what got the airlines in trouble post 1999. (obviously 9/11 putt he petal to the metal on it though)Although you are too deathly afraid to respond to what I present to you I’m still 100% positive that you read everything. Otherwise you wouldn’t be so angry and trying to constantly insult.

Do you know anything about Debt? Do you know there’s a difference between having good debt and bad debt? Good debt is borrowing used to generate income. Meaning in our business borrowing money to buy Airplanes. Bad debt is debt on the books that has no value. Such as old unused leases and old airplanes.

How many people do you know who have a Mortgage and a Car Loan? Is a Mortgage a good thing? Probably so if your payment is less than what you would spend to rent and you’re building equity. A car loan is also a good thing since it gets you to the place where you can get a paycheck to pay for your debt.

Many many many people in America today have more debt than what they’re worth. And most of them are in no way under any threat of Bankruptcy.

No I’m not at all concerned.

View attachment 16945

Buying airplanes can be good. The issue is, American added a metric **** ton of debt buying airplanes they didn't need to buy. Arguing they would get huge costs savings from new airplanes wrapped up in debt.

two problems with them. During a lot of that time, they just weren't seeing the fuel savings they presumed they would see (because fuel dropped post Obama administration) and its also very arguable they saw the gains promised from the maintenance "holiday".

And when American was buying all these plane, United's and Delta's CEO were happy tp point out the flawed logic and ended up being correct. Chasing "lowest average fleet age! woo hoo look at us!" is great till you take on a bunch of bad debt doing so and then not even really doing so as United and Delta (in that order) were able to get their average age down as well.

Now had oil stayed on its rocket ship path it was on during most of the Obama's administration, what you said might have been correct. American's management lost badly on the gamble.

The other issue American had and still has. They just don't make the money Delta and United (lessor extent) make. So while Delta was paying off debt (down to ~$6B pre-COVID), United was paying off debt (down to around ~$10B pre-COVID), American didn't (~$24B pre-COVID). Delta and United suckered American's management, BOD and shareholders in buybacks that American couldn't afford to do and pay down debt aggressively at the same time.

And thus American is in a situation now that is VERY concerning. Because they will once again lack the revenue advantage comparable to Delta and United while looking at a recession right in the face. And SWAMT correctly pointed out, with a DOJ lawsuit already over the NEA stuff, a big key to American's plan in the Northeast to outsource most of its domestic flying to jetBlue, plus use B6's current network to try to compete with Delta/United.

Now throw in a Spirit merger and NEA is almost certainly dead (minus a white house change more willing to allow something like NEA)

and of course if NEA some how survives that is all assuming jetBlue does. They are an absolute mess and could figure out how to make money last quarter with everyone else. Not sure if it is looking better for Q3 or not.

As E said the 200 unencumbered planes sounds great but are they 777-200ERs? Or are the 787-9s? Being able to park planes (and not pay for them) when needed is huge. But that only works when you need to park 200 or less planes. When you need to rapidly park 201, now I need to worry about using the planes I have to rase cash. Well, You aren't getting a ton of case for a 25 year old 738.

exactly this.Yeah, go on, you company cheerleader, you... 😉

15+ years away from AA has indeed given me a different view. AA's a financial time bomb waiting to go off.

They've got nothing of value to try and leverage aside maybe from that nifty new HDQ complex, and who wants bigger offices in a day of remote work?...

Nobody needs route authorities anymore like they did 20 years ago before Open Skies agreements, and they can't just sell off a regional to United or Delta.

Their only hope right now is to make sure there's enough cash coming in to service the existing debt service.

What will be left to do is try and get concessions from labor (And does anyone seriously think they'll cooperate?... ) and ask the banks to renegotiate the debt.

Problem is they just did all that in 2014. That's ages ago in normal life, but banks tend to remember longer than a Twitter timeline or Instagram story...

If things stay as they were this summer and American's management can stay disciplined they might dig out of it.

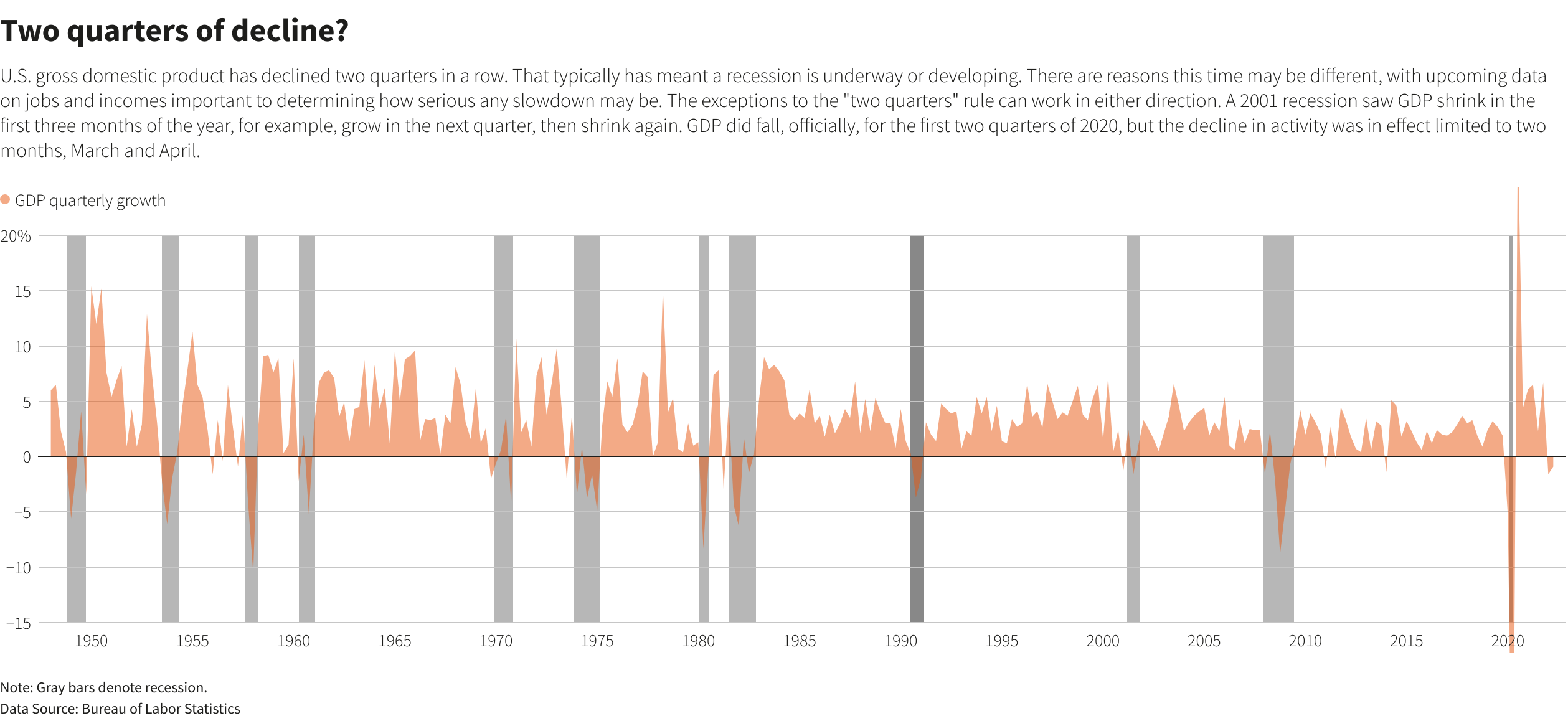

The issue is we are in the early stages of a recession(as much as people wanna change the definition so "See it isn't TRUE!). US airlines right now are living on leisure and VFR travel as they wait for the corporate market to rebound/it become clearer what the post COVID corporate market will look like/still waiting for Asia to open back up and see how the marketplace rebonds there.

But that means the big three are living off of one of the first things that gets cut in a recession.

negative GDP growth isn't the only thing showing such a thing. Oil prices are dropping for a reason and the US housing bubble is starting to show signs of busting. I also believe I saw something from some of the big stores in the county (Wal-Mart, Amazon etc) that said they are starting to see softness in not necessity spending.

all of that points to bad things for the airlines in this country but American and ironically jetBlue are the two in the worst shape.