eolesen

Veteran

- Jul 23, 2003

- 15,937

- 9,366

During closing arguments on the B6-NK trial, one of the lines of questioning from the judge hint at approval with divestitures. He then disclaims it saying it's part of the thought process.

Still, I'd be surprised if it wasn't approved with conditions and goes against the DOJ's objections. They haven't substantially blocked too many mergers, and this Administration doesn't seem to have too many wins in general when it comes to actual interpretation of law and statutes...

aviationweek.com

aviationweek.com

Still, I'd be surprised if it wasn't approved with conditions and goes against the DOJ's objections. They haven't substantially blocked too many mergers, and this Administration doesn't seem to have too many wins in general when it comes to actual interpretation of law and statutes...

JetBlue-Spirit Judge Weighs Divestitures, Considers Injunction Limitations | Aviation Week Network

The Judge, noting the industry's post-pandemic dynamic, said he was “having trouble” with a permanent injunction and was “hesitant” to implement the measure.

“Suppose as I work through this, and think what I have before me is insufficient and warrants some restraint, but with some more divestitures it might work … Should I go down that route?” U.S. District Judge William Young asked attorneys for the U.S. Justice Department (DOJ), one of a few hypotheticals he posed during the Dec. 5 session.

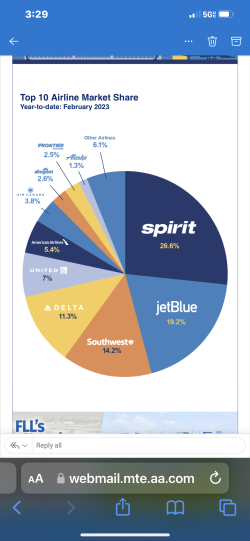

“Don’t I have to look out in the future?” Judge Young asked DOJ in considering the financials. “We’re not going to get anywhere if you win, I enjoin this merger, and Spirit goes belly-up.” DOJ projected that, at most, Spirit’s growth would slow, pointing to its past growth rates, while reiterating a central argument that a merger would result in the elimination of roughly half the ULCC capacity in the country.