on www.justplanenews.com theres an article on CAPA that clearly states American is to be positive for the 2nd quarter and its really an interesting article and its positive too for AA

American positive for 2nd Qrtr

- Thread starter robbedagain

- Start date

-

- Tags

- article on capa

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

JFK Fleet Service

Veteran

WorldTraveler

Corn Field

- Dec 5, 2003

- 21,709

- 10,721

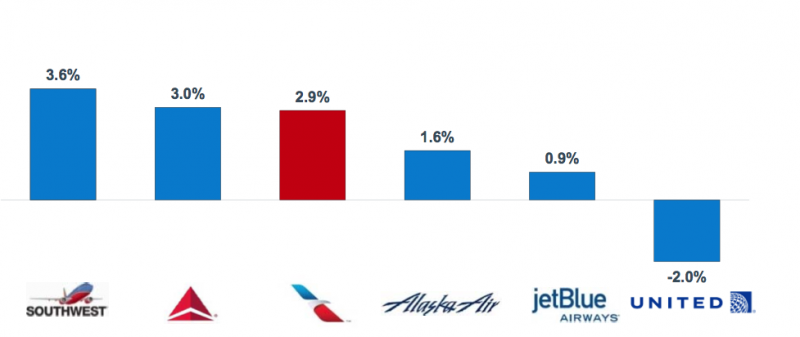

looks just beautifulThis one says it all to me... Unit revenue growth for 1Q14:

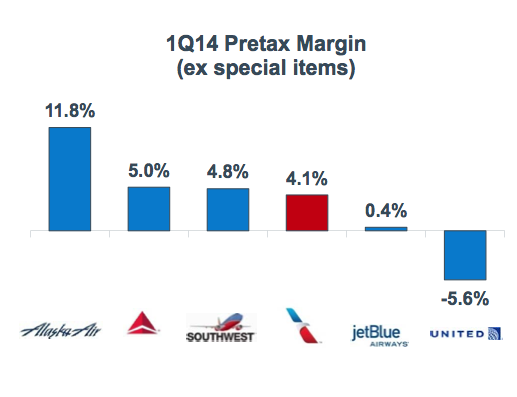

This isn't too shabby, either. And keep in mind this is before the merger synergies have been fully leveraged to extract maximum shareholder value:

WorldTraveler

Corn Field

- Dec 5, 2003

- 21,709

- 10,721

actually, merger benefits are already showing up and will continue to show up. The improved pricing environment, increased flow of traffic across the network, and competitive advantages (loss of UA codeshare) are showing up now.

The advantages will be offset by the costs of integration which a previous report which has been posted shows that all of the megamergers so far have cost more than expected and the costs have exceeded the revenue benefits.

Thus, it isn't a surprise that the carriers that have finished their merger integration are the ones that have been able to show the greatest amount of overall profitability.

The advantages will be offset by the costs of integration which a previous report which has been posted shows that all of the megamergers so far have cost more than expected and the costs have exceeded the revenue benefits.

Thus, it isn't a surprise that the carriers that have finished their merger integration are the ones that have been able to show the greatest amount of overall profitability.

Yes robbed. Here is some more positive facts about 1Q results. Posted in SWA but this one belongs here:robbedagain said:on www.justplanenews.com theres an article on CAPA that clearly states American is to be positive for the 2nd quarter and its really an interesting article and its positive too for AA

Overview: American-US Airways merger has positive 1Q revenue

WorldTraveler

Corn Field

- Dec 5, 2003

- 21,709

- 10,721

true, but also note that costs at AAL are expected to grow more than at DL, WN, or UA.

note also that the article cites the greatest increases in TATL capacity are coming from AA and its TATL JV partners.

also, none of the US airlines have provided guidance regarding revenue adjustments related to Venezuela which could impact revenue as well as most impact AA which is the largest US carrier to that country.

note also that the article cites the greatest increases in TATL capacity are coming from AA and its TATL JV partners.

also, none of the US airlines have provided guidance regarding revenue adjustments related to Venezuela which could impact revenue as well as most impact AA which is the largest US carrier to that country.

Here is maybe how they will work thru the cost:

Overview: Does American have funds to pay debts and expansion?

I would be willing to predict record numbers for AA in the future...

Overview: Does American have funds to pay debts and expansion?

I would be willing to predict record numbers for AA in the future...

WorldTraveler

Corn Field

- Dec 5, 2003

- 21,709

- 10,721

that's the same article I cited previously.

it's not a question of whether AA can meet its debts... I for one am not doubting that.

And yes AA will likely post record profits.

The question is where AA's profitability will lie given that they face potential revenue adjustments and also are expected to see costs rise higher than other airlines due in large part to the merger related costs which I have cited are expected to exceed revenue benefits.

Airlines that have completed their mergers or are further along the path have lower merger related costs and lower overall cost growth.

The article you cited specifically notes that.

it's not a question of whether AA can meet its debts... I for one am not doubting that.

And yes AA will likely post record profits.

The question is where AA's profitability will lie given that they face potential revenue adjustments and also are expected to see costs rise higher than other airlines due in large part to the merger related costs which I have cited are expected to exceed revenue benefits.

Airlines that have completed their mergers or are further along the path have lower merger related costs and lower overall cost growth.

The article you cited specifically notes that.

hp-csr-phx

Senior

WorldTraveler

Corn Field

- Dec 5, 2003

- 21,709

- 10,721

good question... just remember that the slot divestiture and the fall of Wright are also on AA's horizons as well as increased competition to Asia and on the west coast for UA.

WorldTraveler

Corn Field

- Dec 5, 2003

- 21,709

- 10,721

no, robbed,

they are the facts.

I'm sorry you don't understand them.

AA's profits will increase when it has completed paying the bills for the integration - just like has happened with other mergers, UA excluded. AA also has plenty of competitive changes coming to its network over the next few months. If you think that is not a fair statement, let us know what other carriers will be facing anything comparable to the fall of Wright or the addition of about 50 low fare carrier flights at DCA, one of US' most profitable hubs.

Doesn't mean their profitability won't be very strong and better than what AA has seen for many years. but those are the facts.

they are the facts.

I'm sorry you don't understand them.

AA's profits will increase when it has completed paying the bills for the integration - just like has happened with other mergers, UA excluded. AA also has plenty of competitive changes coming to its network over the next few months. If you think that is not a fair statement, let us know what other carriers will be facing anything comparable to the fall of Wright or the addition of about 50 low fare carrier flights at DCA, one of US' most profitable hubs.

Doesn't mean their profitability won't be very strong and better than what AA has seen for many years. but those are the facts.

- Status

- Not open for further replies.

Similar threads

- Replies

- 25

- Views

- 5K

- Replies

- 63

- Views

- 9K

- Replies

- 10

- Views

- 2K

- Replies

- 14

- Views

- 3K

- Replies

- 92

- Views

- 8K