robbedagain

Veteran

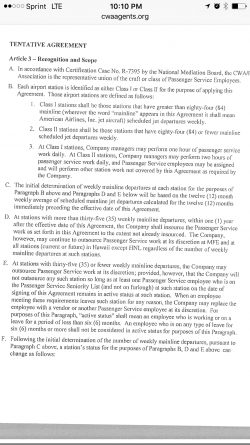

grandfather in all current mainline cities and keep the 7 a week mainline

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

grandfather in all current mainline cities and keep the 7 a week mainline

I say between 8 or 10 otherwise we at LUS are really getting bent over. But here is where it gets complicated with 8 flights that would mean alot of stations would be staffed which I don't expect and wouldn't want to give up something for, so I would imagine we would keep all we have now with grandfathering.

Any bets on what the new threshold of mainline departures will be, under scope, regarding future outsourcing of work in outline stations? An Article they are yet to exchange proposals on. Still a lot left on the table Brothers and Sisters.

I love it ograc. This is your particular area of main interest IMO.

We should at least match what the PSA has currently which is 5.

Let's hope NYer doesn't think that's unreasonable too though?

You were wrong trying to sell it to the members. Period.

I'm waiting for the Weez and NYer to finally have a duel or get a room one or the other

Back to this one. It's not about plans because the plans are only administered by who the company contracts to present and pay for Medical expenses.

It's about costs or projected costs since to point out to you again the Company is self insured.

What the company actually is looking for is the appearance that we are all being treated equally. Meaning if one person is paying $300.00 per month well so is everyone else in the company too.

Appearances are a concern for the Company but shouldn't be a concern to you or me.

Do you think if the APA could one day capture the same Profit Sharing formula as Delta Pilots they're going to worry about any other Unions or people on the property? Of course not.

It's not just the initial costs; it is having everyone in the same plan which lowers their costs because it pools more people some of which will use the plan and others won't. Having several programs with different criteria and different costs makes them more expensive for the participants because there are fewer people paying into them to offset the outlay an insurance company may be paying out.

When the Company makes decisions in the negotiations room, they also consider and argue how a decision in there could impact everyone else. Since we are the last group to finish the JCBA process it makes it much more unlikely there will be a different outcome than what everyone else has received.

I'm sure the Association is going to do everything they can but this is probably going to be the Company's "must have" over any other item in the JCBA.

We didn't sell. Period.

He's too bi-polar to have relationship with.

You're not getting this. The Company is the insurer as they are self- insured. In theory they calculate what their projected costs will be and require us to pay a percentage subsidy for those projections. Their payout costs from last year actually went down on 2 of our plans and why they actually lowered those costs assumptions passed on to us for this year.

They raised the cost on the Value plan by 10% because too many people enroll in it and are trying to entice people away from it to avoid the possible future Cadillac Tax that would be added to their costs for offering the benefit.

As a matter of fact if there were any true reason they would want to break themselves away from that IAM pricing it would be to avoid that Cadillac Tax being placed on the Employer which could be a bill they would have to eat if we were locked in to lower cost offerings.

Remember the talk at AA when the Cadillac Tax plan first came up was that AA would have to have discussions with the Unions about those Cadillac taxes if their plans were so generous that they hit that Tax, and may have to discontinue offering such great benefits.

AA again being the insurer would eventually be asked by the IRS what do you offer as far as medical benefits to your employees.

It's about the value offered in those plans that will cause a concern for how much the company wants us to pay in footing those bills.

So yes the Association and the Company are going to need to come together to be prepared if that Tax is ever enacted and what the solution will be to either trying to avoid it or who is going to pay that bill.

Call it what you want. You were subtly trying to push people in a certain direction instead of just letting them make their own choices.

Your belief again (remember) being that if/when they did file for BK the Judge would look more favorably on our group because we were trying to work collaboratively with the Company.

The International Reps at the time having made a big mistake not gaining the Legal advice that we would have been in a worse position had we gone forward with it. (I paid very close attention to Sharon Levine at that MIA Roadshow)

Anyway it's water under the bridge I guess since we didn't go forward with it and all those Reps are now gone.

Onwards we move.

The Cadillac Tax, if it ever became an issue, would probably be assumed by the Member and not the Company.

Even if you want to go with "they're self-insured" thing, the premise is the same. The more people they have in the plan the lower their costs become. It also lowers their administrative costs since they only need to manage 3 plans for all groups rather than 3 plans for each group.

It wasn't subtle, the need to vote based on the consequences of a no vote was a loud and the direct point being conveyed. The writing was on the wall as the NMB made it perfectly clear of their desire to have the agreement voted on by the Members. The last time that point was made, they put us on ice for almost a year.

Part of the decision to allow that TA to go for a vote was the possibility, and that time it wasn't a probability, of the Company going into a BK. Before the Thanksgiving holiday, the APA was advised of an imminent filing for BK which they didn't take seriously since they called off negotiations until after the holidays.

Sharon Levine, at that point, had already been consulting with the TWU for more than a year.

Yes the premise is similar but here lies the difficulty.

The more the company raises the costs to their employees the more those employees may seek out alternative plans outside the company or not take the insurance at all if they are young and feel they don't need to worry about it.

In effect you sort of create your own feedback loop where you begin to create your own problems.

To the company's credit (and the ACA) creating wellness programs where employees can receive money back for participating in them can in effect bring down some of there's and our costs and maybe keep people in the company's plans.

In your current roll perhaps you should consider joining in an initiative with local management to promote and encourage more participation in those programs? I think it would benefit all of us if you engaged in collaboration on an effort?